Only a few private loan lenders will approve you for a private loan by using a 311 credit score score. Nonetheless, there are some that do the job with negative credit rating borrowers. But, personalized loans from these lenders feature high fascination charges.

Credit rating Strategies is devoted to offering extensive sources for boosting your credit history score. Our verified tactics have assisted plenty of men and women increase their economical overall health and credit score ranking, empowering them to accomplish their life targets.

When you've paid from the loan, you have usage of The cash moreover the gathered curiosity. It's partly a discounts Instrument, but the true reward will come as the credit union experiences your payments towards the nationwide credit score bureaus. Providing you make regular on-time payments, the loan may result in credit rating-rating advancements. (Prior to getting a credit rating-builder loan, make certain the credit score union experiences payments to all 3 national credit rating bureaus.)

Catch Up on Missed Payments: If you’ve skipped some every month payments, generating them up could help protect against credit score injury from worsening, assuming your account hasn’t defaulted nonetheless.

Review Credit Stories for Mistakes: Your “terrible” rating could be the result, at the very least in part, of erroneous info on your credit rating experiences. So Test your hottest credit report for such things as accounts you didn’t open and on-time payments mistakenly detailed as late.

You might be better off retaining that outdated account open up, assuming you don’t should pay an yearly payment. It's possible you'll even take into consideration putting a small recurring demand — like a regular monthly subscription — on the cardboard to make sure the account stays Energetic and also the credit card business doesn’t shut it to suit your needs.

Diversify your credit rating accounts: Aquiring a good mix of credit score accounts, such as charge cards (revolving credit history) and installment loans (like mortgages or automobile loans), can positively effects your credit score scores. Lenders choose to see that you could regulate differing types of credit rating responsibly.

These cards need a deposit that acts as your credit history Restrict, building them easier to get and helping you rebuild your credit score as time passes. An alternative choice to think about is locating a co-signer or looking into prepaid debit cards. Although these alternatives will not likely right away resolve your situation, they are able to function practical applications on your own journey towards financial balance. It is important to notice that desire rates on any sort of credit score available to persons with such scores are usually substantially better, reflecting the higher perceived chance to lenders.

Use it responsibly by earning compact buys and spending from the balance in whole on a monthly basis to build a favourable payment background.

Credit builder loans are installment loans that happen to be especially intended to aid individuals with very poor credit rating Develop or rebuild credit history heritage. In fact, credit history builder loans never require a credit score Look at in any way. As well as, it’s possibly the cheapest and simplest way to spice up your credit score scores.

Promotion permits WalletHub to deliver you proprietary resources, products and services, and written content at no charge. Advertising doesn't affect WalletHub's editorial content material which includes our best charge card picks, critiques, rankings and opinions.

It’s also achievable that you just check here haven’t crafted credit rating in any way. No credit history is actually similar to negative credit.

Due to this fact, your odds of obtaining permitted for a decent automobile loan are trim. You have got to Examine your options diligently and think about both placing a bigger down payment or buying a car or truck that’s less costly.

Why? Due to the fact You may have a much better likelihood at receiving permitted for just a shop credit card with very poor credit. The possible downside is usually that these cards often come with superior fascination fees, and it's possible you'll only have the ability to make use of them at a selected keep.

Christina Ricci Then & Now!

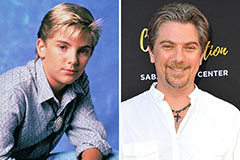

Christina Ricci Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Barry Watson Then & Now!

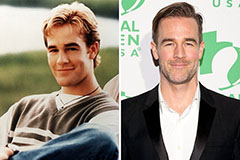

Barry Watson Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!